Check out the companies making headlines in the premarket Tuesday:

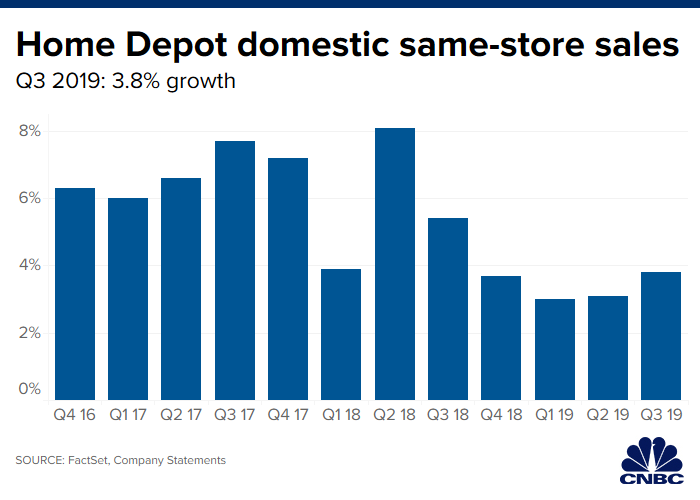

Home Depot — Home Depot shares dropped more than 5% in the premarket after the home improvement retailer reported disappointing same-store sales. The company said global same-store sales rose 3.6% in the previous quarter. Analysts polled by Refinitiv expected growth of 4.7%.

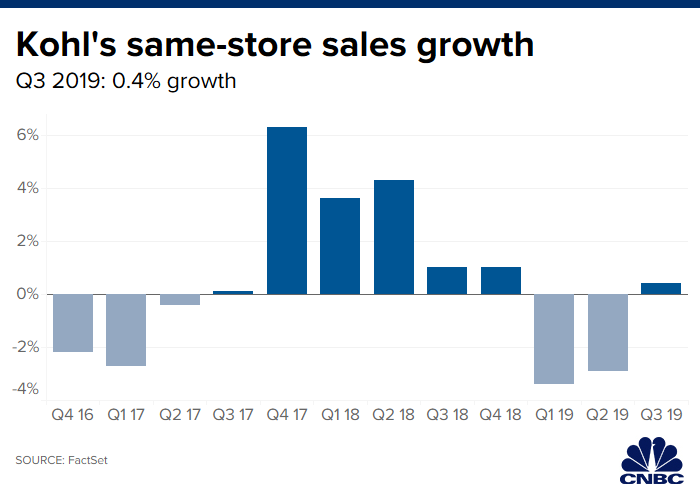

Kohl's — Shares of the retailer tanked more than 10% on the back of disappointing quarterly results. Kohl's reported earnings per share of 74 cents on revenue of $4.358 billion. Analysts polled by Refinitiv expected a profit of 86 cents per share on revenue of $4.399 billion. Same-store sales, a key metric for retailers, also missed expectations.

Boeing — The aerospace giant wrangled up 50 bids for its embattled 737 Max jet at the Dubai Air show. Air Astana, a carrier based in Kazakhstan, announced a letter of intent for 30 of the planes while an undisclosed buyer ordered 20 more.

MSG Networks — An analyst at Guggenheim downgraded MSG Networks to "sell" from "neutral," citing a "challenged negotiating position as it approaches contract renewals covering ~40% of its subscriber base." The stock fell more than 3% in light trading before the bell.

Broadcom — The chipmaker was upgraded to "overweight" from "equal weight" by an analyst at Morgan Stanley. The analyst also raised his price target on Broadcom to $367 per share from $298 a share, and noted he sees "possible value creation as it extends into software and builds on a current strong position in semis."

Disney — Multiple reports said hackers have stolen thousands of Disney+ accounts and put them up for sale on the dark web. News site ZDNet said prices for those accounts ranged from $3 to $11.

PG&E — The embattled California electric company is nearing a settlement of more than $1.7 billion with state regulators for maintenance failure of equipment involved in the 2017 wildfires, Bloomberg News reported, citing people familiar with the matter.

Alibaba — Alibaba will stop taking orders for its Hong Kong initial public offering earlier than expected amid strong demand, sources with direct knowledge of the matter told CNBC.

Medtronic — Medtronic shares gained 2% in the premarket on the back of better-than-expected quarterly numbers. The company posted earnings per share of $1.31 on revenue of $7.706 billion. Wall Street expected a profit of $1.28 per share on sales of $7.657 billion. The company also raised its fiscal 2020 earnings outlook.

—CNBC's Michael Bloom contributed to this report.

https://www.cnbc.com/2019/11/19/stocks-making-the-biggest-moves-premarket-home-depot-boeing-disney.html

2019-11-19 12:50:00Z

52780439152414