Last week, President Trump threatened to place a 10 percent tariff on $300 billion worth of Chinese imports on September 1 unless trade talks with China showed more sign of progress. Already, America has tariffed $250 billion of Chinese imports at 25 percent, and if tariffs are placed on the $300 billion basket of goods, this would increase tariffs on all Chinese imports to the United States.

President Trump is unhappy that talks last week in Beijing between Chinese officials and U.S. Trade Representative Robert Lighthizer and U.S. Treasury Secretary Steven Mnuchin broke down. He’s also unhappy that China hasn’t followed through on a promise to purchase more U.S. agriculture goods, like soybeans, in exchange for the United States allowing our chipmakers (think Intel and Qualcomm) to supply chips to Huawei, a Chinese telecommunications giant.

There are risks to the president’s strategy. While the trade war has yet to significantly affect U.S. consumers, global business sentiment has been negatively affected as global supply chains have been upended, and the $300 billion basket of goods to potentially be tariffed next month is much more consumer-oriented than the $250 billion basket already tariffed.

China can also attempt to retaliate, even though its ability to do so is limited because it doesn’t buy that many American goods. And even China’s tariffs on U.S. agriculture are more complicated than the media would have you believe. For example, China restricted U.S. pork imports since 2011 by spuriously claiming U.S. pork is unsafe. And because African swine fever (ASF) is wiping out China’s pig population, and pigs eat soybean meal, China is demanding less soybeans generally, even from Brazil.

What’s Behind the Latest News

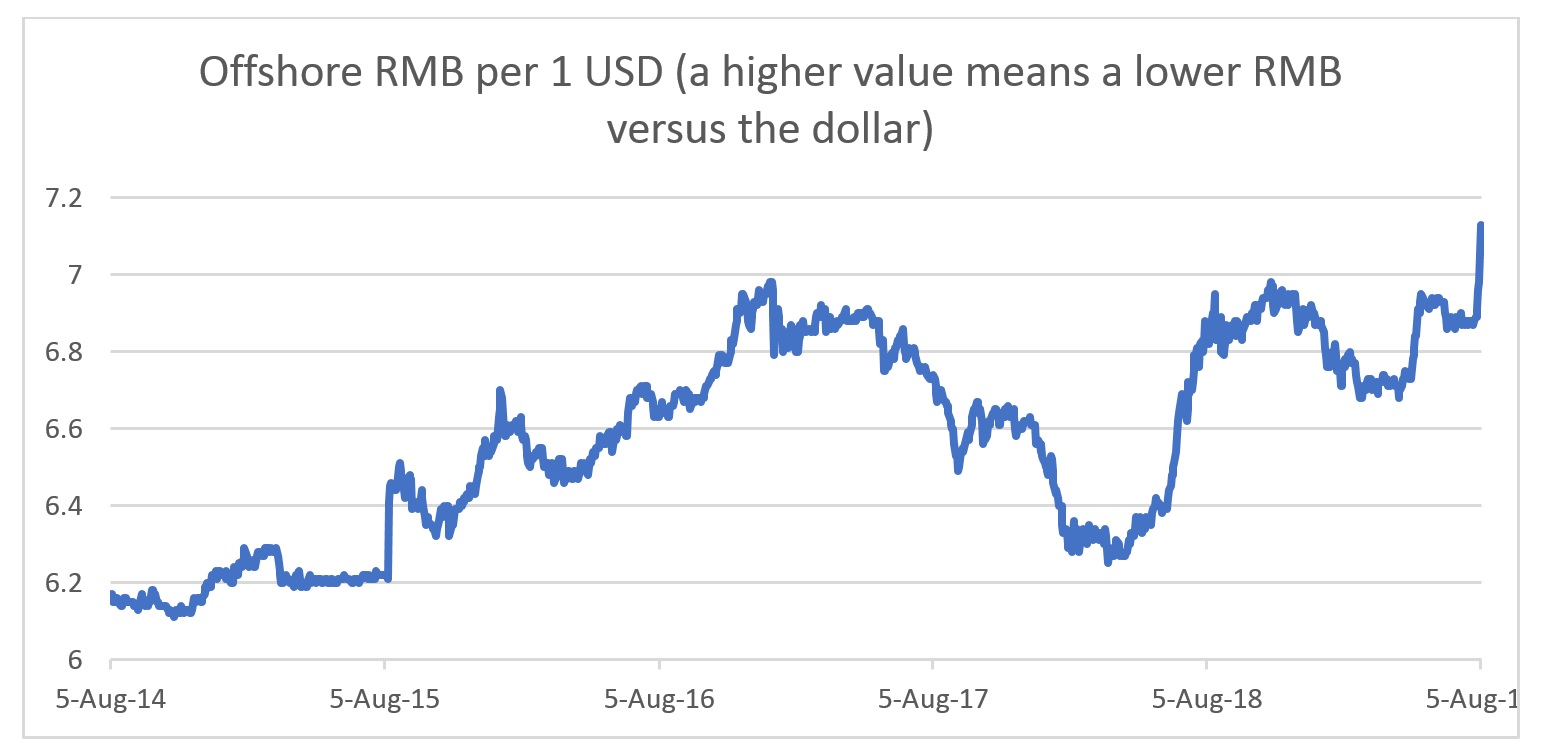

China is responding to Trump’s tariff threat by allowing their currency to weaken versus the dollar.

But the one channel where China could “retaliate” was in their currency rate, because a weaker Chinese currency helps keep Chinese goods attractive to American buyers, despite higher tariffs. China’s currency, called either the yuan or the renminbi (RMB), is pegged by the Chinese central bank (the People’s Bank of China, or the PBOC) to a basket of currencies, chiefly the dollar. The PBOC usually moves the peg higher or lower as it pleases, but market forces also push and pull on it. It is harder for the PBOC to fight the market on a prolonged basis, especially when the RMB wants to move lower.

In years past, China used its peg to suppress its currency value even as it ran huge trade surpluses. In a free market, China’s currency value would rise over time due to the world buying its goods, yet China instead printed RMB and sat on the dollars it received. The RMB printing caused bubbles in China, and sitting on the dollars kept China’s exports super-competitive, by keeping China’s wages artificially low in U.S. dollar terms.

Then several years ago, fearing serial bubbles and a slowing Chinese economy, capital began to flow out of China and the PBOC found itself instead defending its currency from weakening too much. The same is true today—China’s economy is slowing, and coupled with trade tensions with America there is market pressure on the RMB to move lower versus the dollar (in most countries, a slower economy means a lower currency value).

That brings us to Sunday night, when the PBOC allowed the offshore (non-China) traders betting against the RMB to have their way, and the value of the RMB compared to the dollar dropped to the lowest level in years, breaching what traders call the “seven handle” (the dollar now buys more than 7 RMB, up from buying only 6 RMB several years ago).

China’s Move Could Backfire

The PBOC’s move to allow the RMB to weaken against the dollar offsets the sting of tariffs on Chinese exporters, but it carries two important risks for China.

First, that the United States retaliates to the currency devaluation, which is exactly what happened on Monday evening, when the U.S. Treasury Department acted to officially label China a currency manipulator, the first time since the 1990s. The action doesn’t have any immediate consequences, but it acts as a warning to China and can open the door to future penalties on Chinese imports to America.

The second risk is that the PBOC is unable to stop a further RMB slide, which would cause capital outflows and tight money in China, which would crash China’s all-important property market, and thus its economy. It is highly complicated, but even when the PBOC wants easier monetary policy, the stimulus channel is “clogged” if the dollar is rising versus the RMB and money is flowing out of China.

These risks, and the simple fact that the trade war is escalating, explain the market reaction. Equities the world over fell after the announcement. In the United States, the S&P 500 (a good measure of U.S. stock performance) and the Dow Jones Index (a lesser measure of U.S. stock performance) fell by roughly 3 percent, and the NASDAQ index (which is tech stock-heavy) fell by about 3.5 percent.

Here’s the Bigger Backstory

Why Trade Talks Broke Down

President Trump is right: The economic relationship between America and China really is unfair. When Trump took office, the average U.S. tariff on Chinese goods was around 3 percent, and the average Chinese tariff was around 10 percent. A multitude of hidden rules restricted American firms’ ability to do business in China.

Worse, China has long had a quasi-official policy of stealing U.S. intellectual property. U.S. firms that seek to operate in China are forced to partner with a Chinese competitor via “joint venture requirements.” That competitor gets to see their business practices and trade secrets. And to gain a license to operate in China, American firms are forced to hand intellectual property to Chinese officials. Often, these officials give these corporate secrets to local Chinese companies.

China does this because it is obsessed with creating a domestic industry in everything, and is willing to subsidize loss-making companies until they have a foothold. This has worked in some areas—like Huawei with telecoms and China’s train industry—where a firm that was started with stolen technology is now out-competing western firms on their home turf. In other areas—like chipmaking or automobile production—China’s progress has been shoddy, despite access to competitors’ technology.

Some say American companies choose to hand over technology to operate in China. But America doesn’t make Chinese companies do this, and even American companies that don’t operate in China are at risk of Chinese corporate espionage. There are currently almost 1,000 separate FBI investigations into Chinese corporate espionage, at least one in all 50 U.S. states. President Obama got Chinese President Xi Jinping to sign something saying the hacking and theft would stop, but it actually increased the next year.

Trump aimed to fix this, and several months ago his trade team, led by Lighthizer, got China to agree to allow U.S. firms more access to China, increase intellectual property protection and enforcement, and end protectionist measures aimed at restricting the import of U.S. goods, among other things.

But China wanted the United States to remove tariffs immediately, and for political, business, and legal reasons, America wanted to see compliance first. Given history, the Trump administration doesn’t trust that China will stick to its word. The lack of trust wasn’t helped by China, twice at the last minute, trying to change the Chinese-language-version of the trade agreement without America knowing.

China May Never Agree to a Deal

It is highly possible that China never intended to adhere to the terms of a deal. There is a debate as to whether China can politically implement America’s terms or not. But it’s safe to say that enforcing the deal would require Chinese President Xi Jinping to expend a lot of political capital, and even alienate certain politically powerful groups—including Chinese industries that would face competition if American firms and goods were allowed more access to China.

Either way, the talks broke down, and have been stalled for several months. And Trump has so far followed through on his tariff threats.

This Isn’t All about Trade

But this isn’t only about trade. Sometimes stocks are looking for a reason to move lower. The backdrop to all this, which further explains the move, is twofold.

First, people were incredibly on one side of the trade (“net long”) on U.S. equities going into the Federal Reserve rate cut last week, which underwhelmed after U.S. Federal Reserve Chair Jerome Powell tempered expectations for a large amount of future cuts. When traders are crowded on one side of a position, moves can be sharp in the other direction as the popular trade is unwound.

While some on Wall Street have been saying that rate cuts are always bullish for stocks, many are learning otherwise. If the Fed is cutting while the economy is deteriorating—like in the early 2000s or before the Great Recession—stocks can still go down.

The second reason this isn’t all about trade has to do with the global economy. Generally, global economic data has been pretty awful in the last 12 months. Even in the United States, which has been outperforming the rest of the world since Trump’s deregulation and tax cuts, growth is starting to slow.

The big picture behind this slowdown is that the global economy was rolling over in 2015-16, and then the Chinese enacted the biggest stimulus in human history. Global data surged higher, in what Wall Street called the “synchronized global recovery.”

But since last year, Chinese stimulus has run its course, and they can’t stimulate like that again even if they wanted to. That has led to weakness in everything from gauges of Chinese economic activity to gauges of German activity since the back half of last year.

The truth is that the Chinese stock market peaked in late 2017-early 2018. It surged on hopes of a trade war resolution and new Chinese stimulus at the beginning of this year, but those hopes quickly rolled over.

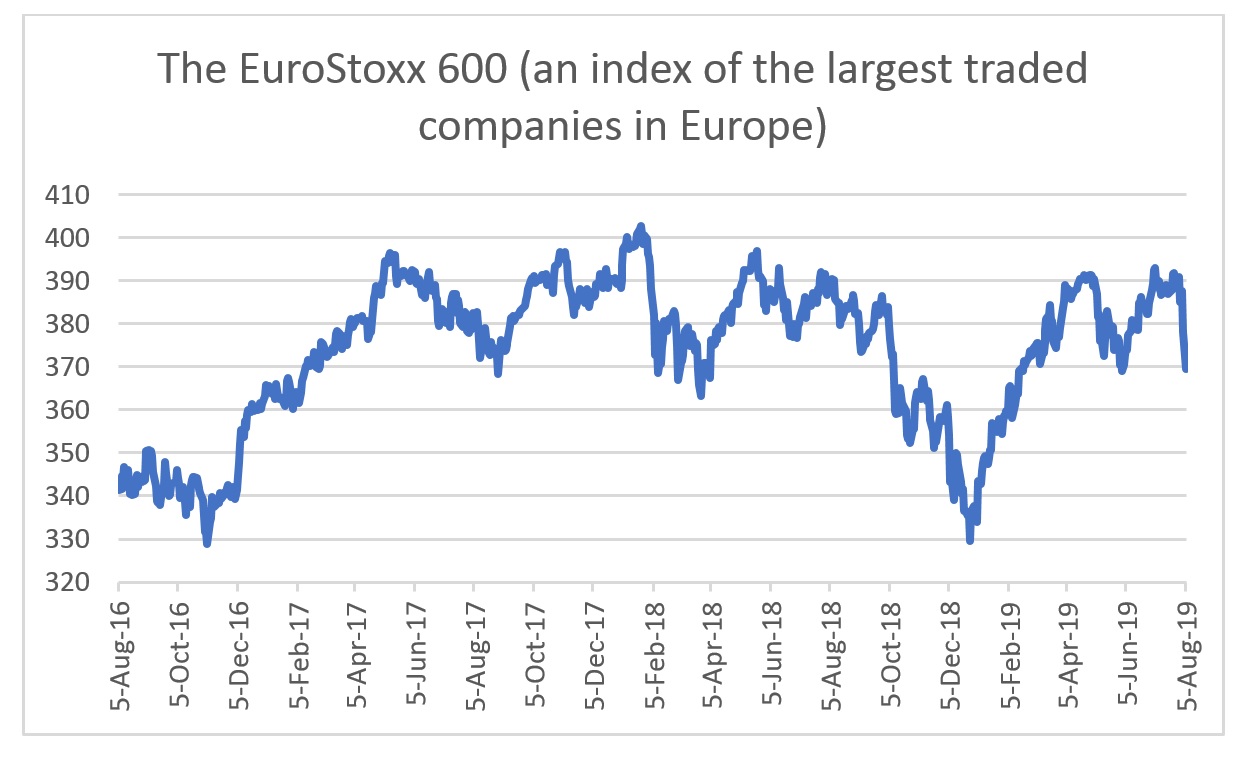

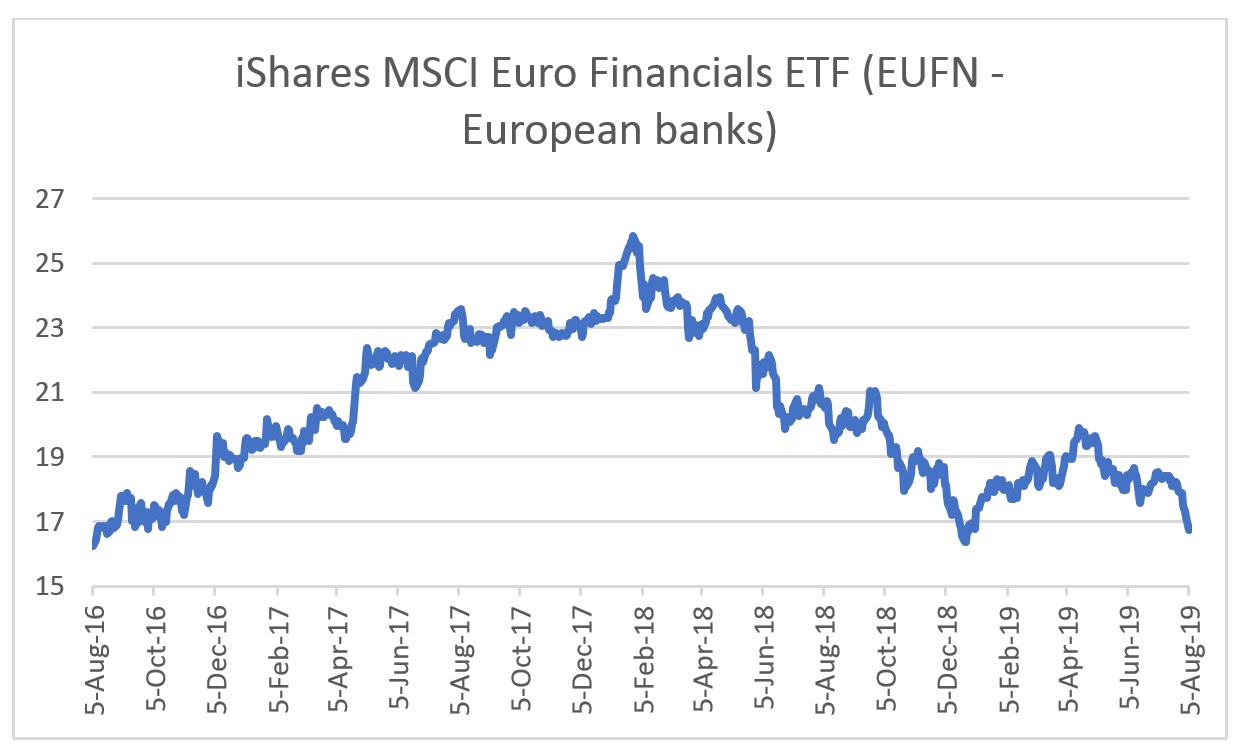

China isn’t an outlier. European stocks also peaked in late 2017-early 2018. Nowhere is this more apparent than Europe’s beleaguered (some would say awful) bank stocks. Again, this has nothing to do with tariffs, and everything to do with the global economic cycle after the massive Chinese stimulus ran its course.

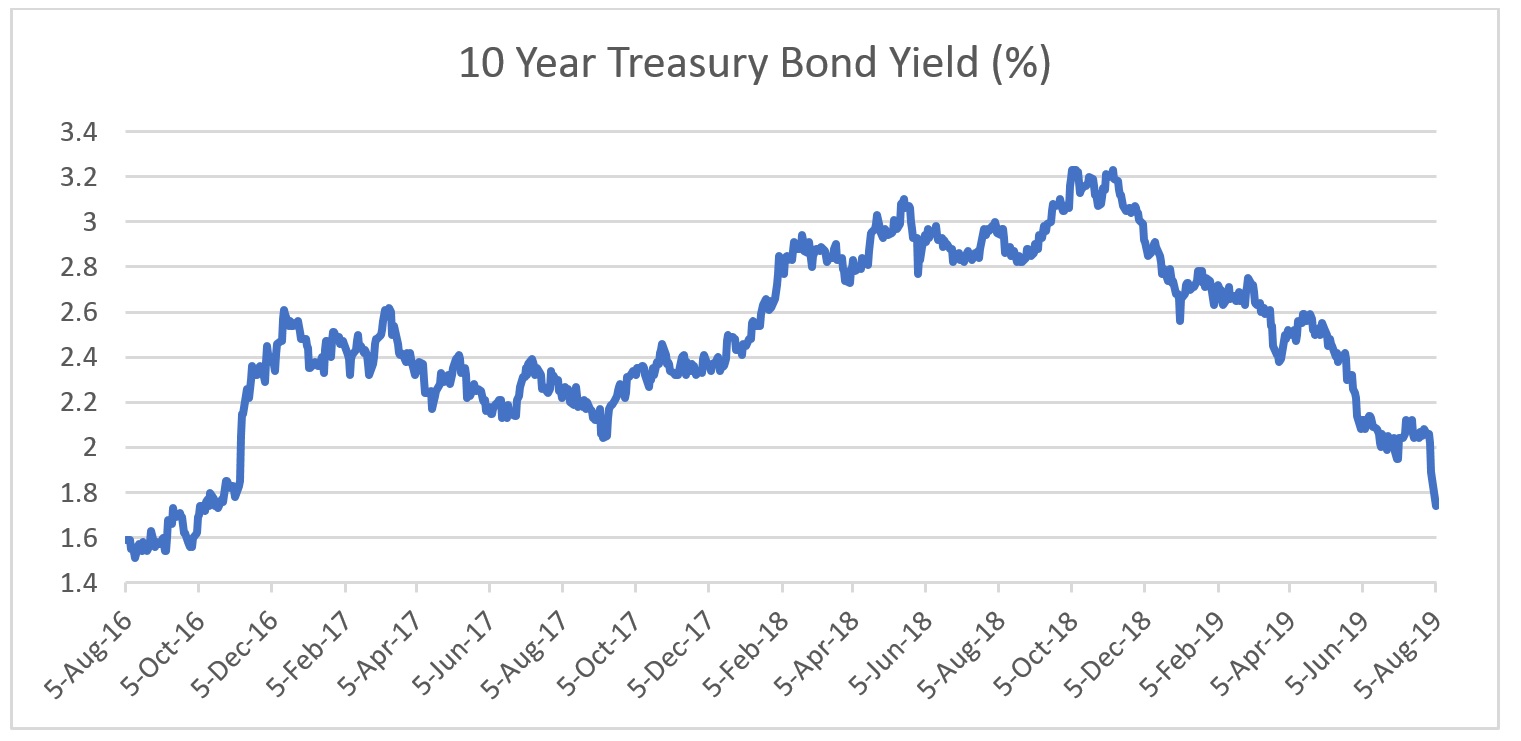

Meanwhile, the United States outperformed the rest of the world in 2017-18. But now, some of the boost from U.S. tax cuts is running out, and tax reform is already well priced into U.S. equity valuations. As a result, the 10-year Treasury yield, a measure of growth, has been signaling lower U.S. and global growth since it peaked in late 2018.

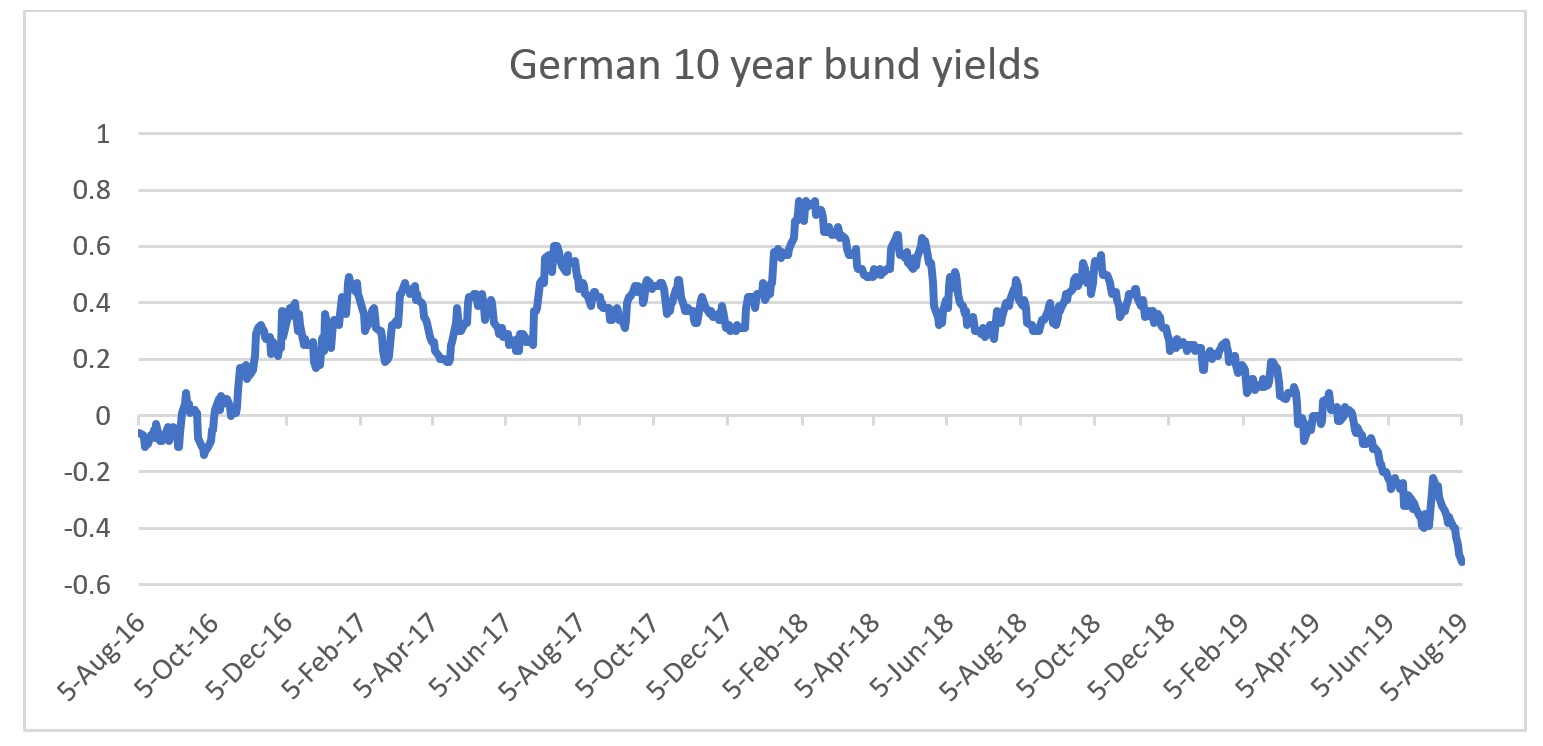

Lest you think the move lower in Treasury yields is happening in isolation, here’s a chart of 10-year German bund yields.

In other words, don’t listen to the left scream that tax cuts caused a slowdown, and don’t listen to the supply siders who say tax cuts would be working great, and would be causing greater capital expenditure, were it not for tariffs. Tariffs don’t help prolong the cycle, but America is highly insulated from global trade compared to the rest of the world, and the American consumer—most exposed to global trade—looks fine for now.

The credit cycle is the credit cycle, and a lot of it is now out of the control of the Fed, China, Trump, and tariffs. In fact, the epicenter of any global recession will likely be in Europe and China, not in America, although America does have a corporate debt bubble.

How This All Affects Politics

Trump is wagering that being the tough-on-China candidate will help him win reelection, and he’s probably right. His path to the presidency runs through the Rust Belt.

The de-industrialization of America has had terrible consequences for large pockets of the country, even if what we call free trade generally benefits a majority of Americans. An economist looks at people and thinks they are better off because they can buy cheap plastic toys at Walmart, even if they lost their factory jobs. Trump understands that people aren’t happy, and he (and a few other GOP politicians like Sen. Josh Hawley) understand that happiness is derived from a steady job and stable family life, not cheap imported goods. People aren’t math equations.

But further escalation in the trade war could dent the global economy. No president since World War II has won election on the back of a recession. In the United States, we could escape recession given our insolation from the global economy, however. What really matters is the change (in fancy lingo, the “delta”) of real disposable income growth and the unemployment rate.

The absolute level is less important. Even if the unemployment rate moves higher and stocks lower, as long as employment is increasing and stocks moving higher in the months before the election, Trump is set for a second term.

What can you do about all this? Stick close to your families. Live good and honest lives. And realize that in America, if things are to get better—measured not just by our economic circumstances but by our family and spiritual circumstances—our material wealth might have to get worse first.

https://thefederalist.com/2019/08/07/trade-war-isnt-reason-dows-big-drop/

2019-08-07 11:22:51Z

52780345840537