Sotheby's auction in Hong Kong.

Anthony Wallace | AFP | Getty Images

Sotheby's auction house announced Monday that it has signed an agreement to be acquired by BidFair USA, a venture wholly owned by French media entrepreneur and art collector Patrick Drahi.

Sotheby's stakeholders will receive $57 per share in cash as a result of the transition, a premium of 61% to the company's stock price on Friday. The deal is valued at $3.7 billion.

The transaction, if approved by shareholders, would result in Sotheby's returning to private ownership after 31 years as a public company traded on the New York Stock Exchange.

The stock rallied about 57% in early trading Monday following the news.

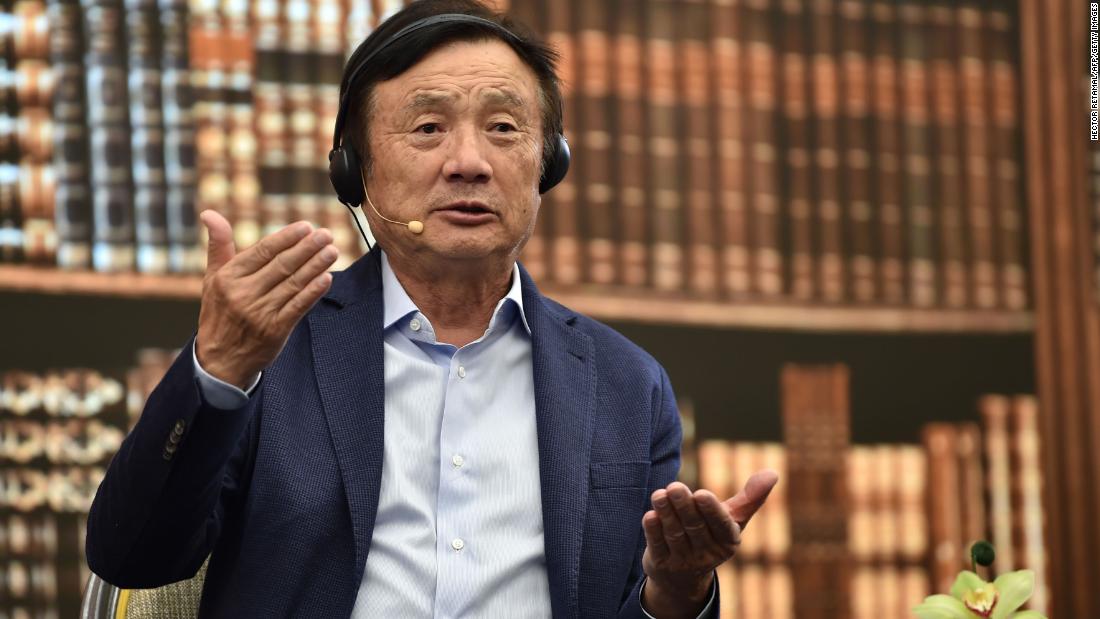

President of French telecoms and media group Altice, Patrick Drahi smiles during the inauguration of the Altice Campus in Paris on October 9, 2018.

Eric Piermont | AFP | Getty Images

"Patrick Drahi is one of the most well-regarded entrepreneurs in the world, and on behalf of everyone at Sotheby's, I want to welcome him to the family," Sotheby's CEO Tad Smith said in a press release. "This acquisition will provide Sotheby's with the opportunity to accelerate the successful program of growth initiatives of the past several years in a more flexible private environment."

Sotheby's was No. 2 in the world among art auction houses in the first half of 2018 with a turnover of more than $2 billion. CNBC's David Faber first reported that Sotheby's would be sold, citing people familiar with the matter.

LionTree Advisors is serving as financial advisor to Sotheby's while Sullivan & Cromwell is acting as legal counsel.

https://www.cnbc.com/2019/06/17/sothebys-is-in-talks-to-be-sold-sources.html

2019-06-17 13:01:09Z

52780316190136