The Supreme Court says consumers can sue Apple for allegedly monopolizing the App Store

In a 5-4 decision, the Supremes ruled that consumers can proceed with a class action.

The issue: Apple charges app makers a 30% commission on every app sale, while preventing developers from selling their apps on Apple devices outside the App Store. The people suing Apple say the company effectively passes on that 30% fee to customers, who have no choice but to buy apps on the App Store.

Apple’s argument: The tech giant said customers were not “direct purchasers” from Apple, but rather from the app makers themselves — an argument the court did not agree with.

What this ruling means: Now, the lawsuit can move forward in courts. It could potentially open Apple up to a class-action settlement or a loosening on its grip on the sale of apps for its devices.

The big picture: The App Store accounts for billions in revenue for Apple, so Apple has a lot to lose here.

Sri Lanka has blocked most social media networks after a Facebook post sparked anti-Muslim protests

The country temporarily banned Facebook, Instagram, and YouTube and instant messaging apps Snapchat, Viber, WhatsApp, and IMO after a Facebook post led to attacks on mosques and Muslim-owned businesses across several towns.

The ban comes three weeks after jihadist bombers targeting churches and hotels killed almost 300 people in Sri Lanka on Easter Sunday, sparking fears of sectarian violence against the country’s minority-Muslim population.

This was the third time in weeks the country had banned social media in the wake of religious tension.

Broader context: Read Megha Rajagopalan on why banning social media in Sri Lanka doesn’t make sense.

SNAPSHOTS

Elizabeth Warren pledged to replace Betsy DeVos with a former public school teacher if she wins in 2020. Sen. Warren’s announcement was a sign of how DeVos, President Donald Trump’s education secretary, has become a rallying point for Democrats on the campaign trail

Angela Merkel doesn’t want either of the EU’s top jobs. Merkel will quit politics when she steps down as German chancellor, and has privately made clear she’s not interested in leading the EU.

Monsanto has been ordered to pay more than $2 billion to a couple with cancer. A jury awarded $2 billion to an elderly couple that developed non-Hodgkin's lymphoma after years of using Monsanto's popular weed killer Roundup. The jury found the company failed to warn consumers that Roundup could cause cancer, attorneys said.

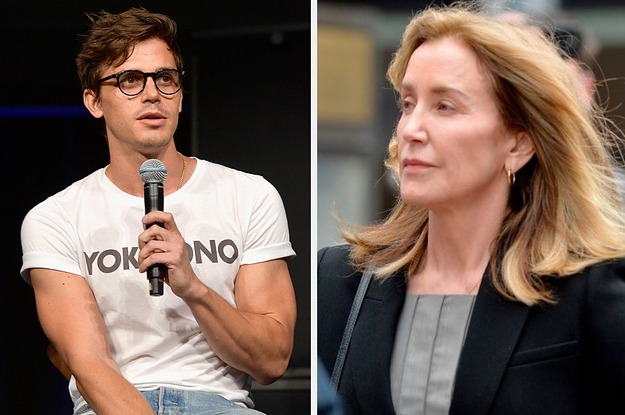

Felicity Huffman admitted she paid $15,000 to increase her daughter’s SAT score. The Desperate Housewives actor pleaded guilty on Monday. Prosecutors recommended she be sentenced to four months in prison.

A DC Metro worker is “hurt and embarrassed” after a writer called her out in a viral tweet for eating on the train. Natasha Tynes tweeted a photo of the Metro employee eating on the train, complaining it’s against the rules. Tynes’ tweet earned viral backlash — and she may have lost a book deal. Metro authorities say the worker will not be punished.

A teen decorated her graduation cap to direct people to a list of students killed in school shootings. Gina Warren compiled a list of victims killed in mass shootings at American high schools. She plans to wear a QR code on her cap at the graduation ceremony that will send people to the list.

YouTube’s newest far-right, foul-mouthed, red-pilling star is a 14-year-old girl

The future is here and I don’t like it.

“Soph” has become a rising star with more than 800,000 followers, in the universe of conspiracy theorists, racists, and demagogues that owes its big bang to YouTube.

The thing is, “Soph” is 14. Here’s how our reporter Joe Bernstein describes one of her videos: “a cherubic white girl mocking Islamic dress while lecturing her hundreds of thousands of followers about Muslim ‘rape gangs,’ social justice ‘homos,’ and the evils wrought by George Soros — under the thin guise of edgy internet comedy.”

As Bernstein writes, “The video platform for years has incentivized such content through algorithms favoring sensational videos.”

And where has that brought us? “This is what indoctrination looks like when it’s reflected back by the indoctrinated.”

We need to talk about Antoni from Queer Eye’s shirtless Mother’s Day selfie

Look, first of all, I’m not here to police your thirst — I’m on your side here.

Having said that, Queer Eye star Antoni Porowski may have stretched the line of what constitutes a thirst trap occasion.

Antoni posted a shirtless selfie that was a “shout-out to all the moms.” The photo, which showcased 36 abs and muscles I didn’t know existed, was a hit, but people were confused as to what, exactly, it had to do with Mother’s Day.

While people lovingly dragged Antoni for the thirst trapping, many said it would be rude to be ungrateful for such a gift.

https://www.buzzfeednews.com/article/elaminabdelmahmoud/morning-update-the-thirst-trap-is-the-occasion

2019-05-14 10:35:00Z

CAIiEBWc-3bXgzGheIfNOsF6f1cqFwgEKg4IACoGCAowjJ0RMKC-AjCp1rAF